⚡ Earnings Check: Constellation Energy (CEG)

Something needs to power all that AI - bullish for CEG

Constellation Energy (CEG) reported a confident Q1 2025, beating earnings expectations and reaffirming its long-term growth outlook.

But this quarter wasn’t just about the numbers—it was about the message: Constellation is quickly becoming the go-to clean energy partner for powering the AI boom.

CEO Joe Dominguez delivered one of the most strategically assertive calls we've seen from a utility in years, hammering home why CEG’s nuclear-heavy fleet, pricing flexibility, and national reach give it a long-term edge.

While shares have rallied significantly, and short-term technicals suggest some cooling ahead, the company’s alignment with secular AI and data center trends makes it a rare high-quality compounder in the energy space.

This could be a Buy for long-term investors, with a suggested tactical entry point on a pullback to $235–260.

What They Reported

Q1 Adjusted EPS: $2.14 (vs. $1.82 last year)

GAAP EPS: $0.38

2025 EPS Guidance Reaffirmed: $8.90–$9.60

Free Cash Flow Before Growth: ~$2B projected

Nuclear Output: 41M MWh, 94.1% capacity factor

Stock Buyback: $1B remaining, paused temporarily due to inside info (MNPI)

What Stood Out

🧠 Strategic Positioning for AI

CEO Joe Dominguez didn’t hold back:

“The U.S. must win the AI race... and the administration is taking steps to ensure that we will.”

Big tech firms like Amazon, Meta, and Google are building AI infrastructure that consumes enormous amounts of energy. Constellation is positioning itself as the clean energy backbone behind that transformation, thanks to its nuclear fleet’s ability to provide large-scale, reliable power. Key here is the re-affirmed CapEx plans are bullish for CEG.

“Locating AI facilities near large, clean, reliable power plants makes all the sense in the world.”

Perhaps most striking: CEG is no longer dependent on “behind-the-meter” energy deals (where customers must build right next to a power plant). That concern has been eliminated.

“We are now convinced we can achieve fair pricing... regardless of whether a client chooses to be near our plant or in a remote area.”

This opens up nationwide potential for AI power contracts—and eliminates regulatory hurdles that previously slowed deal-making.

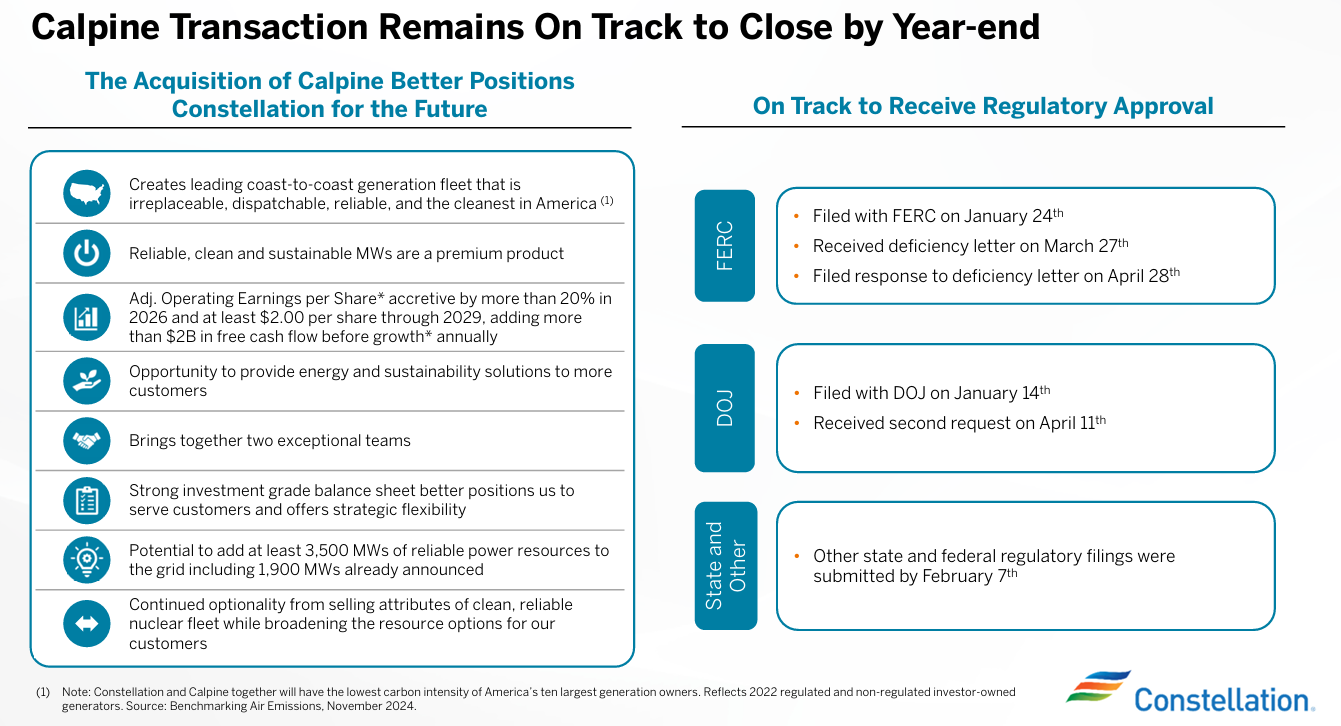

⚡ Calpine Deal Looks More Valuable

CEG’s pending acquisition of Calpine—a fleet of natural gas plants—was pitched as a timely bargain. Dominguez called the assets:

“Worth twice as much as what we paid.”

Why? Because building new plants today is way more expensive than it was a decade ago. Calpine’s already-built infrastructure saves time and avoids inflated construction costs.

🏛️ Clear Signals from Washington

“I haven’t had a single conversation in Washington where AI hasn’t come up.”

On the conference call Dominguez repeatedly tied Constellation’s role to national economic and security priorities, citing bipartisan support for nuclear tax credits and infrastructure investment. He made clear that Constellation’s role in AI infrastructure is not just business—it’s public policy.

🔐 Inflation-Protected Earnings

Thanks to nuclear Production Tax Credits (PTCs), Constellation’s earnings actually benefit from inflation. The inflation adjustment for 2025 (estimated at 2.3%–2.6%) adds ~$500 million to future revenues through 2028.

“This is a unique inflation hedge... very few companies can offer this kind of earnings predictability.”

🧠 AI Forecast & Risk Profile

Based on our current AI-generated investment models:

Short-Term (1 Month):

Rating: Buy

Target: $240.61

Expected Return: -3.08%

Comment: Momentum is strong but potentially overdone. A pullback is likely.

Mid-Term (3–6 Months):

Rating: Strong Buy

Target: $271.12

Expected Return: 9.2%

Tailwinds: Earnings growth, clean energy exposure

Risks: Valuation stretch, regulatory noise

Long-Term (1 Year):

Rating: Strong Buy

Target: $302.11

Expected Return: 21.7%

Sharpe Ratio: 0.51

Probability of Success: 73.25%

Comment: One of the strongest large-cap clean energy setups backed by predictable earnings, growing demand, and favorable policy.

The Valuation Lens

Current Price: ~$277

Forward EPS: $8.90–$9.60 → Implies 28–31x forward P/E

Utility Sector Avg: 18–20x

EV/EBITDA Multiple: Elevated vs. peers, but justified by asset mix

Cash Flow: ~$2B before growth investments

Buyback Firepower: $1B remaining

It’s not cheap—but this is a strategic premium play in a sector where most peers are capped by regulation or commodity sensitivity.

Final Take: Buy Long-Term, Wait for Pullback

Constellation is doing something different. While most utilities focus on regulated returns and incremental rate base growth, CEG is actively shaping the energy backbone of the next computing age. Management is executing a playbook that combines aggressive strategy, operational discipline, and macro tailwinds few others can claim.

But i think investors should be patient. The stock is up ~12% on the week, RSI is elevated, and short-term returns may stall.

My Plan

Accumulation Zone: $235–260

Hold Zone: $260–290

Target Zone: $300+ (12-month horizon)

If you're looking for a long-duration asset with income, growth, and a direct line into the AI buildout, Constellation is hard to beat.

The other play here is also VST which reports Wednesday Before Market Open.

Trade wisely,

Les

My analysis, your money. Use your common sense.