Lululemon: An interesting stock to monitor at these levels

After a 30% price drop... it's time to take a closer look.

Today, we look at Lululemon - combining earnings, technical analysis, and our proprietary AI analysis to determine if the stock is at a good point to start a position.

Let’s dive in.

Latest Earnings Overview

Lululemon's fiscal year 2023 concluded with strong earnings, characterized by a 19% surge in annual revenue, hitting $9.6 billion, while quarterly revenue grew by 16% to $3.2 billion. The company's fourth-quarter earnings per share (EPS) settled at $5.29, outperforming the adjusted EPS from the same quarter of the previous year, which was $4.40. The company's gross margin expanded notably, reaching 59.4%, evidencing operational efficiency and a sound growth trajectory (Yahoo Finance).

Investment Analysis: Lululemon's robust financial performance reflects solid market confidence, further reinforced by its effective Power of Three x2 strategy. This approach emphasizes innovation, driving momentum across sales channels, product categories, and geographies. Despite a sluggish start to the year in the US market, Lululemon's international business, particularly in China Mainland, continues to demonstrate exceptional growth, a promising sign that bolsters the company's global brand appeal and offers a bright outlook for future expansion.

Current News Impact: The consumer environment in the United States has presented challenges at the start of 2024, but Lululemon's management is optimistic about maintaining growth and market share. Their international performance, especially in China, is notably robust, counterbalancing any stateside sluggishness.

Outlook with Earnings Context: Looking into 2024, Lululemon's Q1 observations are cautiously optimistic. They foresee continued strength in most regions and have planned initiatives to bolster their position in the US market. The company's unwavering commitment to product innovation, particularly in footwear and fabric technologies, aligns with its strategy to expand brand awareness and its customer base. The launch of their footwear collection and the upcoming reveal of Team Canada's Olympic kits are specific examples of initiatives expected to drive growth and engagement in the forthcoming year, demonstrating Lululemon's ability to adapt and stay ahead of market trends.

Despite all the positive indications regarding earnings, the stock dropped over 30%.

From a Trailing P/E standpoint, this is the cheapest shares have been since September 2017. (Chart below courtesy of Fast Graphs)

SMA Insights AI/ML Model Synopsis

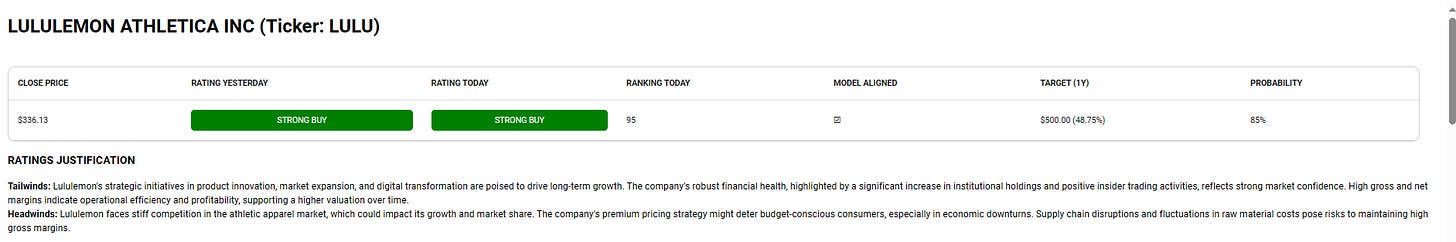

SMA Insights has set a one-year target price for Lululemon's stock at $500, indicating a potential 48.75% increase, with an 85% probability assigned to reaching this target.

This optimistic forecast is supported by Lululemon's strategic initiatives and consistent performance across various market segments.

Our short-term machine learning models also suggest that Lululemon is due for a bounce. These models focus on pattern recognition and look at 5/10/20 day price movements.

Technical Analysis

The technical charts for Lululemon indicate that the stock has encountered a support level on a weekly scale. This observation suggests potential stability for the stock price, consistent with the bullish sentiment derived from the company's solid financials and market strategy.

Note: There is an overhang in the short term with the focus on the Fed's reaction to inflation numbers and interest rate cuts. The S&P and QQQ indexes are likely due for a short-term dip/correction.

Lululemon is ultimately a consumer discretionary item, and additional drawdowns could be seen before the stock resumes a bounceback. I would not be surprised at a drawdown from the starter position given the indexes current positioning.

With that in mind, we will likely take a starter position at $342 and continue to monitor for strength in the bounce back. A move above $347-$350 would indicate continuation.

Conclusion

We want to use a combination of analytical tools to speed up our equity analysis and tilt the odds in our favor. Our AI insights platform helps us get one step closer in this endeavor.

Trade wisely,

Les

Disclosure: The author has a starting position in Lululemon.

We are not a financial advisor. Our platform provides recommendations generated by AI models. The final call on any investment will rest with you as you have the best view of your risk, timeframe, investment objectives, etc.

Interested in our AI insights platform? Please sign up here and we will notify you when we launch.