It’s the weekend, and we have a lot to cover, so let’s get right to it.

Index Review

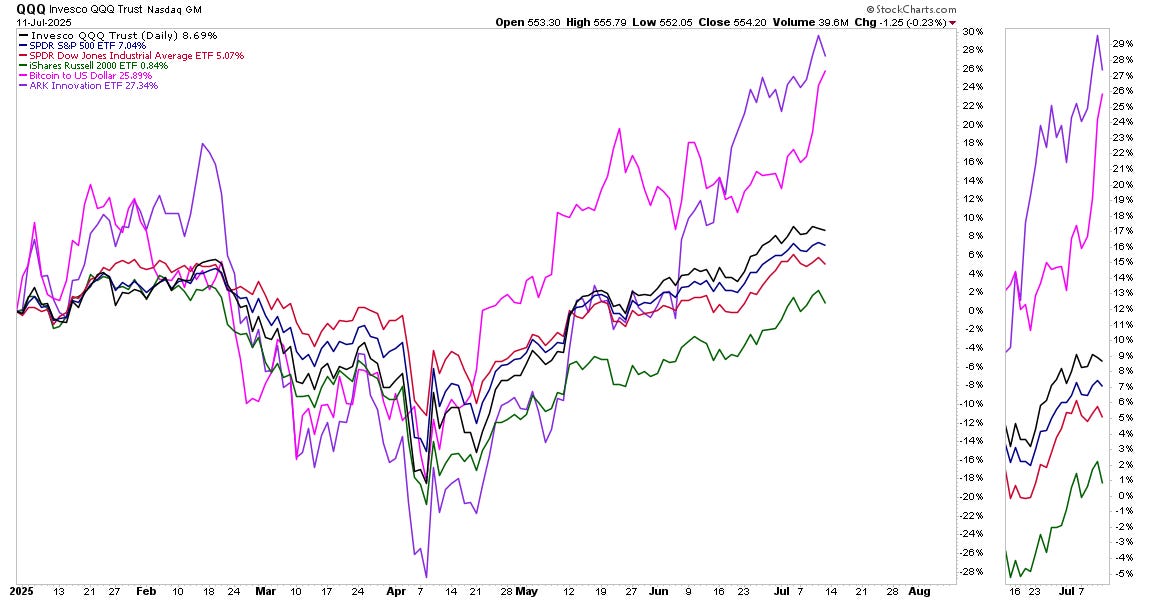

As of July 11, 2025, here's a concise year-to-date (YTD) performance analysis of key indexes and ETFs based on the chart:

ARK Innovation ETF (ARKK) is the top performer, up approximately 27.3% YTD, reflecting strong momentum in high-growth, innovation-focused names.

Bitcoin (BTC/USD) follows closely with a 25.9% gain, showing continued recovery and volatility typical of crypto assets.

Invesco QQQ Trust (QQQ), representing the Nasdaq 100, is up 8.7%, leading among major stock indexes and showing strength in large-cap tech.

S&P 500 (SPY) and Dow Jones Industrial Average (DIA) are up 7.0% and 5.1% respectively, showing moderate but steady gains.

iShares Russell 2000 (IWM) lags with only a 0.8% gain, highlighting relative weakness in small-cap stocks (but shows an opportunity to grow).

Takeaways

1. Risk-On Tone, But Not Broad-Based YET

While ARKK (+27%) and Bitcoin (+26%) signal aggressive risk-taking in innovation and digital assets, Russell 2000’s flat performance (+0.8%) shows that smaller, domestically focused businesses are struggling. This divergence is partially driven by tariff overhang, particularly fears of renewed trade tensions. Small caps are more vulnerable to supply chain disruption and rising input costs. If tariff threats subside watch for Small caps to continue pushing higher.

2. Big Tech and Global Players Still Favored

QQQ (+8.7%) shows large-cap tech remains a relative safe haven. These companies often have global supply chains and pricing power, allowing them to absorb or shift costs more efficiently than small businesses. Also, AI demand remains strong and relatively insulated from trade restrictions, helping tech outperform despite tariff noise.

3. Tariff Fears Capping Broader Index Upside

SPY (+7%) and DIA (+5%) gains are solid but underwhelming considering economic resilience. Investors may exercise caution in the industrials, materials, and consumer sectors due to their direct exposure to input cost inflation or potential retaliation from trading partners. This helps explain why Dow components lag even as growth sectors shine.

4. Inflation Expectations Staying in Check... for Now

So far, tariff risks haven’t reignited inflation fears, which supports continued strength in speculative assets like ARKK and crypto. But any escalation in tariff announcements or import cost shocks could pressure margins, raise CPI prints, and shift rate cut expectations, potentially triggering rotations out of high-beta names.

SPY 2-Hour Chart Analysis

SPY remains in an uptrend on the 2-hour timeframe, with higher highs and higher lows since early June. Price is currently consolidating near recent highs (just below 626.28), holding above the rising 50-EMA and 200-EMA, both of which act as dynamic support. The Williams %R is near neutral after bouncing from oversold territory, indicating recent selling pressure has eased. Volume has been steady but not heavy, suggesting no major distribution yet. MACD is flat and slightly bearish, showing momentum is cooling but not yet reversing.

Keep reading with a 7-day free trial

Subscribe to Trading Thoughts with LCC007 to keep reading this post and get 7 days of free access to the full post archives.