Market update: Wall Street's Rally: Trade Relations and Economic Data Fuel Gains

Investors continue chase gains; let's see how long this rally lasts

Couple days into this week, and bull animal spirit is in the air already.

The markets experienced significant gains, erasing year-to-date losses primarily due to improved US-China trade relations and easing inflationary pressures. Investors welcomed the positive developments, notably the resumption of Boeing aircraft deliveries to China, signaling improved international trade dynamics.

Also - theres lots of talk going around about Trump visit to Saudi to hang out with Crown Prince MBS, along with several US business leaders (Elon Musk, Sam Altman, Jensen Huang , Lisa Su). The deal aims to create up to 2 million U.S. jobs and supports Saudi Arabia’s goal to become an AI hub while securing U.S. tech dominance. Among many things, The Saudis are swapping their energy for investments in Defense, AI - . That could spell good news for AI and defense related plays going forward. MBS suggested the partnership could reach $1 trillion.

Speaking of AI, we’re getting ready to launch the Seattle Market Analytics AI Engine for retail investors shortly - this is a great way to stay on top of all the market movements and get AI analysis on direction and price targets for over 2600 stocks! Looking forward to sharing this platform with you soon.

Despite these optimistic signs, caution remains due to ongoing concerns about the temporary nature of the current trade agreement and any unforeseen risks around tax cuts, inflation, and resulting interest rate fluctuations.

The market sentiment was moderately bullish, marked by considerable short-term gains. But after this much movement, there’s a chance now for a dip, so lets be prepped to take advantage of the potential volatility ahead.

📊 INDEX ROUNDUP – Tech Leads, Broad Gains Across Indices

S&P 500: Increased by 0.91% on Friday, completing a strong two-week performance with a total gain of 6.92%. Growth was notably driven by technology and consumer cyclicals.

Nasdaq: Outperformed other indices with a 1.29% increase, significantly driven by heightened investor interest in technology and growth stocks.

Russell 2000: Achieved modest gains but remained tempered by higher volatility typical of smaller-cap stocks.

The great news is that SPY and QQQ are above their 200D moving averages so we’re looking for dip opportunities in the coming weeks to position accordingly.

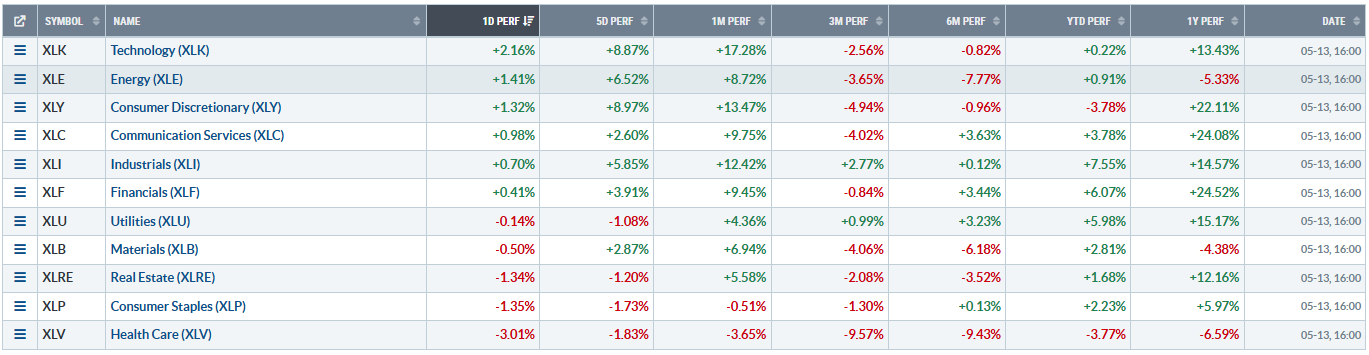

🏭 SECTOR SNAPSHOT – Technology and Consumer Cyclicals Continue to Stand Out

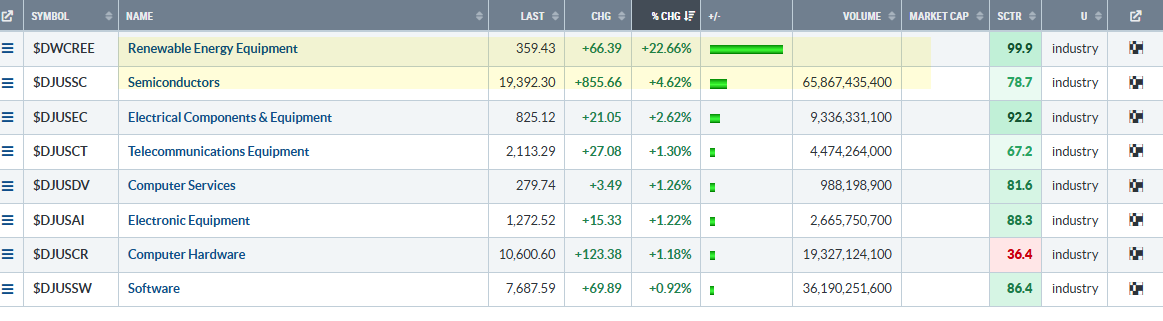

Technology: Led gains with a significant increase of 2.45%, benefiting from easing trade tensions and investor optimism. The outlook remains strong, though sensitivity to economic changes warrants caution. Interesting note here, Solar is coming back (think FSLR GEV).

Consumer Cyclical: Gained 1.47%, bolstered by increased consumer confidence and favorable trade news. Continued growth depends on sustained consumer spending. Not surprising a good portion of the move was in Auto (Read - TSLA)

Energy: Seeing Energy also picking up in the last 5 days. Seeing Coal and Exploration take the lead, will dig into this later in the week. There’s chatter of potential headline numbers of inflation inflation coming (which could lead to interest rate fluctuations). Let’s keep an eye on this.

💡 Strategic Considerations

Technology Sector Strength: Continue to favor technology stocks given their current momentum, but remain mindful of economic risks.

Consumer Confidence Dependent: Monitor consumer cyclicals closely, ensuring positions align with evolving economic indicators.

Mega-Cap Stability: Consider maintaining or modestly increasing mega-cap allocations due to their lower volatility and resilience in uncertain markets.

Today we shared a trade update on COIN and CONL which worked out nicely. Let’s continue to take the trades one day at a time. I also have a couple of additional ideas which I will share with you on chat tomorrow.

Take care and trade wisely,

Les