Team - checking in after a brief examination of the indexes. Make sure to join substack chat as we keep monitoring the market and our positions.

As expected, volatility continues with the Iran/Israel conflict.

For the fourth consecutive time, the Fed kept interest rates unchanged and made it apparent that they are not in a rush to lower them. Despite the cooled outlook and divided opinions, two cuts in 2025 remain possible. The Fed lowered growth expectations and increased inflation projections, moving us closer to stagflation. Powell and his team continue to exercise caution, relying on data and closely monitoring a range of issues such as global tensions, election-year policy risks, and persistent inflation. It's a strict "wait and see" for the time being.

While the indexes have barely moving this week, some specific stocks are performing quite well. We do need to be very picky about what we are holding and trading. This absolutely a stock pickers market right now. And more importantly - stick to strong stocks.

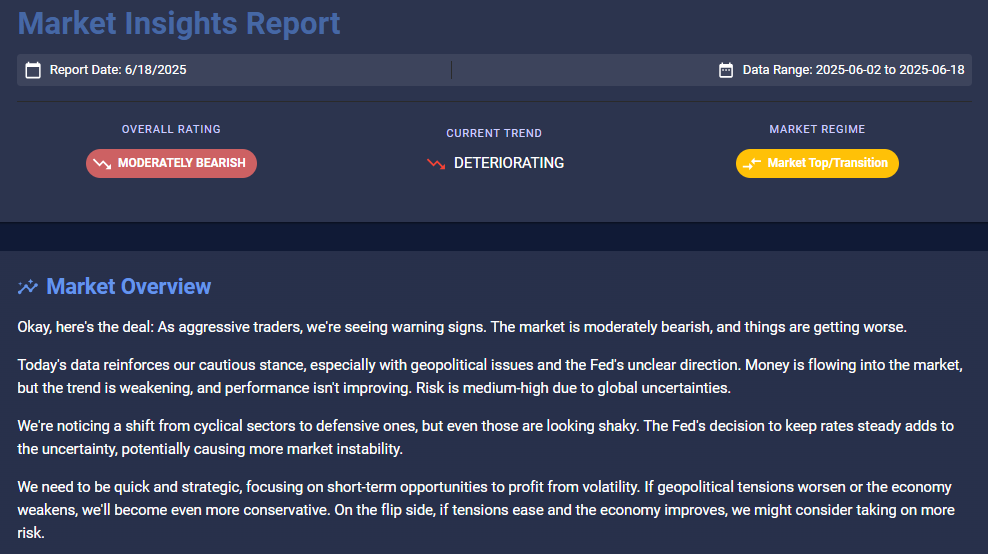

Our AI Insights market report summarizes it well.

For now, we continue to stay nimble…focus on quick strategic opportunities and keep cash handy.

This dashboard and ratings explanation is taken from our new SMA AI Insights Platform, now available to all. Subscribe now for access to 2600+ Stocks, detailed market reviews,

AI Screeners and more!

Let’s check on indexes and some of the names we have been trading the past few days, including a couple new names we just picked up yesterday and today.

There’s now a caution signal on SPY and QQQ in the short term…let’s take a closer look.

SPY is showing signs of stalling after a strong uptrend, now consolidating sideways near $597–$600. It’s holding just above the 100 EMA, which has provided reliable support, but recent price action is flat with lower highs forming since early June. Volume is mixed, and the MACD is flat to slightly negative, showing weakening momentum. Williams %R is near oversold, hinting at possible short-term support, but not strong buying pressure. A breakdown below $595 could signal a deeper pullback, while reclaiming $600+ with strength would resume the bullish bias.

TLDR: SPY is at a crossroads. Still above key support, but losing steam. Watch $595: hold means bounce, break means drop. Bulls need a push above $600 to stay in control.

The QQQ 2-hour chart shows a short-term downtrend developing after a period of consolidation between $534 and $528. Price has slipped below the 21 and 50 EMAs and is testing the 100 EMA (green line) as support near $528. A small descending channel is forming, with lower highs and lower lows, and recent candles show rejection at the 21 EMA. Notable support levels are at $526.86 and $523.88, with resistance around $532 and $534. The volume has picked up slightly on red candles, hinting at selling pressure. Williams %R is near oversold, suggesting possible short-term bounce potential but still weak momentum.

TLDR: QQQ is weakening short-term and may break lower if it can’t hold $527. A drop toward $524–520 is likely unless it quickly reclaims $532. Caution for bulls again similar to SPY. Momentum could favor the bears right now.

I expect that the indexes will have some give back soon. So stay nimble.

Position check

Let’s go through a subset of positions worth talking about. I’ll also go through our mid- and long-term AI targets on our positions. Remember to keep your risk tolerance and time frame in mind when getting into these names.

Oscar Health Inc (Ticker: OSCR) - New Position

This is one we called out in our chat - grats on getting in!

OSCR is still in a long consolidation zone between $12 and $23 on the monthly chart. This could be a sign that institutions are buying up shares while keeping the price compressed. A move over 24 is important from a technical point of view and could mean that the trend is about to change from its multi-year downtrend.

Keep reading with a 7-day free trial

Subscribe to Trading Thoughts with LCC007 to keep reading this post and get 7 days of free access to the full post archives.