📈 SOFI & AFRM: Setting Up Like Another MAJOR STOCK Before Its Breakout?

If this is true...we must pay attention

If you've been tracking names like SoFi (SOFI) and Affirm (AFRM), you're likely noticing something interesting. Their monthly charts are starting to look eerily similar to another large-cap stock right before it exploded out of a long base in early 2024.

I don’t think this is a coincidence. It’s a technical pattern that could offer clues for a breakout in the making.

In this article, I’ll share the comparison of these two stocks against a pattern I’ve noticed, key upside targets based on our AI insights engine…and the plan to capitalize if this pattern plays out.

Let’s get into it.

Chart Comparison: A Shared Story of Accumulation

The stock that I’m referring to here is Palantir (PLTR).

Let’s take a look at the big picture…literally.

On the monthly timeframe, all three names show the classic post-downtrend recovery structure:

PLTR (2022–2023) bottomed at $5.84 and spent nearly 18 months forming a broad base, marked by a horizontal resistance at around $20. It consistently printed higher lows into that ceiling. The breakout finally came in early 2024 with a powerful monthly close above resistance, confirmed by rising volume and momentum follow-through, a break out retest…and PLTR hasn’t looked back since.

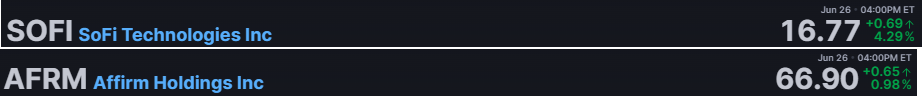

SOFI has followed a similar script. After bottoming at $4.24, it's carved out an ascending triangle structure with resistance around $13.50 to $14.80. Volume has begun to expand on green candles, and the June 2025 close at $16.77 puts it just above that range. This hints at an emerging breakout.

AFRM shows nearly identical behavior. It’s been coiling under resistance at approximately $70, with higher lows and an accelerating slope in recent months. June's bullish close at $66.90 suggests buyers are stepping in aggressively.

What ties them all together is the repeated tests of resistance, combined with rising lows. These are hallmarks of institutional accumulation and bullish pressure building below the surface.

So What Comes Next? Trade Plan & Strategy

If history rhymes, PLTR's chart offers a roadmap for what could come next in SOFI and AFRM. Here's how you might approach it:

Key Levels to Watch

These are the levels I’ll be watching to add to a position for both names

SOFI: Breakout trigger above $14.80

AFRM: Breakout trigger above $73.50

Aggressive traders may want to add and initial now (an initial position) and more on the breakout. One more opportunity may show up if a potential breakout retest occurs.

AI Targets (Measured Moves)

This AI ratings explanation is taken from our new SMA AI Insights Platform, now available to all. Subscribe now for access to 2600+ Stocks, detailed market reviews,

AI Screeners and more!

https://seattlemarketanalytics.ai/

SOFI: $22 to $25 (triangle height added to breakout)

AI-driven forecasts for SoFi align closely with the bullish technical setup. In the short term, the AI model gives a “Buy” rating with a price target of $18.46, reflecting recent momentum and positive sentiment from SoFi’s re-entry into crypto. The mid-term outlook is more cautious (“Hold”), citing valuation concerns and market volatility, which matches the technical expectation of a possible consolidation before further upside.

Long term, the AI projects a target of $24.48, nearly identical to the chart-based breakout target of $22–$25, supported by strong revenue growth and strategic expansion, reinforcing the bullish thesis over a 12-month horizon.

AFRM: $90 to $95 range

AI projections for Affirm (AFRM) support the bullish technical outlook, especially over the long term. The model gives a “Buy” rating for both the short and long term, targeting $79.47 and $98.28 respectively, with projected gains of nearly 20 percent and 49 percent. These align closely with the technical breakout target of $90 to $95, suggesting strong upside potential if the stock clears resistance around $73.50.

The short-term AI forecast highlights momentum from recent partnerships and a predicted near-term gain, which fits the chart’s pattern of higher lows pushing into resistance. While the mid-term outlook is rated “Hold” due to mixed recent performance and high volatility, this mirrors the potential for a brief consolidation before a breakout. Overall, both AI and technicals point to a bullish setup with strong upside if key resistance levels are breached.

An important point here is patience…this isn’t going to be a trade. This is going to be a move based on patience of a breakout and then letting the run…do it’s thing.

Final Thoughts

SOFI and AFRM may not blast off immediately. But the patterns suggest a strong probability of upward continuation, especially if volume confirms the move.

When three different stocks tell a similar technical story, it's worth listening.

PLTR's breakout wasn’t random. It was built month by month, and now SOFI and AFRM look poised to follow. And if this pattern plays out, it pays to be prepared.

So…stay patient, stay prepared, and let price confirm the next chapter.

Trade wisely,

Les

My analysis, your money - use your common sense.