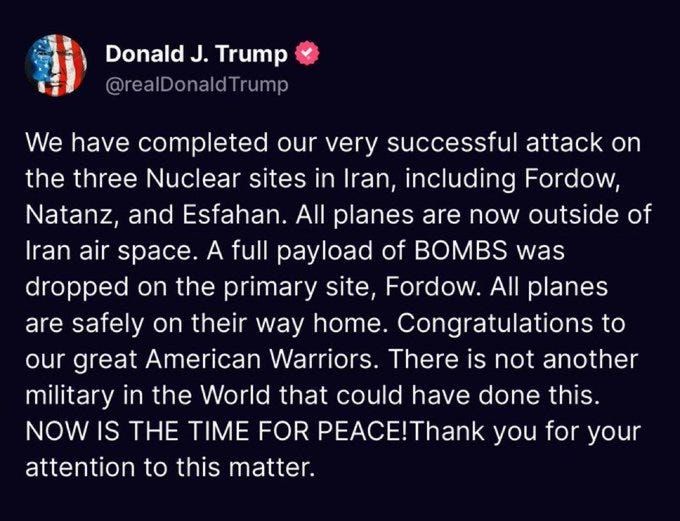

This image is hilarious - Hat tip to the creator on X (whoever you are).

The S&P 500 fell 0.4% last week, wiping out Monday's rally and capping off a volatile stretch for investors.

Early optimism over a possible Iran-Israel truce was swiftly overturned by escalating Middle East violence, sending major indices into the red. While Treasury yields decreased, with the 10-year note closing at 4.38% by the end of the week, the Federal Reserve maintained rates at 4.25% to 4.50%, acknowledging "somewhat elevated" inflation but finding some comfort in cooling CPI and PPI data. Mixed signals were sent by corporate earnings: analysts now anticipate only 4.9% growth in the face of growing global risks, after Q1's strong 13.4% growth was replaced by slashed Q2 projections.

Hold that thought, though. The tape was dominated by geopolitical shockwaves, with Israel's strikes on Iran causing the S&P to drop 1.1% and Brent crude to spike 7% to $74.23. A dramatic U.S. strike on Iranian nuclear facilities over the weekend caused oil to rise above $77 and drag futures down over the weekend.

Traders must now decide whether this intervention will contain the crisis or spark a wider conflict. Interestingly, Sunday's Gulf session defied expectations, with Tel Aviv stocks rising on hopes that U.S. involvement might hasten a resolution. Even though Iran threatened to block the strait of Hormuz, we haven’t quite seen any clear direction of that yet. If a block really happens, we’re looking at further volatility.

Interestingly, this professor seemed to have nailed down about 80% of this scenario over a year ago. Worth a watch.

Last week, we discussed several important points to keep in mind:

June (Especially the second half) tends to be a weaker for markets and a give back period.

We saw energy (XLE) jump to the front on performance and sure enough, that was true heading into the weekend.

Volatility tends to be good for energy and not so great for tech stocks so we talked about being swift and potentially grabbing SQQQ hedges, which we did going into the weekend. Hedges are just that - a defense against unknowns.

That said, we continue to be bullish for the near term into July. This is just about being smart and watching price above all else.

This is absolutely a stock pickers market. How can I tell? SPY has gone almost nowhere for the month of June, and yet specific stocks that we picked are still doing relatively well.

The volatility has also impacted Bitcoin prices, temporarily falling under 100K, although we are seeing a slight rebound into the late hours.

The main thing to watch now is relative strength and specific internals in addition to price.

Keep reading with a 7-day free trial

Subscribe to Trading Thoughts with LCC007 to keep reading this post and get 7 days of free access to the full post archives.