Markets wrapped up the week on a high note, with equity indices recording strong gains across the board. Yet, beneath the surface, investors are grappling with one of the more complex crosscurrents in recent memory. While the headline action suggests optimism, bolstered by easing trade tensions and a strong bid for risk assets, the macro narrative is far from clean.

The biggest after-hours surprise came Friday evening when Moody’s downgraded the U.S. credit rating, stripping away the country’s last remaining AAA from a major ratings agency. While the downgrade had long been expected by many macro watchers, its timing, after a week of strong equity gains, was surprising.

Where were these guys all this time? Really?

Moody's downgraded the U.S. sovereign credit rating on Friday due to concerns about the nation's growing, $36 trillion debt pile, citing "rising debt levels, persistent deficits, and a lack of political will to restore fiscal balance." Bessent has responded.

Bessent: We've inherited a 6.7% deficit-to-GDP, the highest outside war or recession. Our focus is to grow the economy faster than the debt, that’s how we will stabilize debt-to-GDP.

In any case- there will be potential pressure on the U.S. dollar, and more scrutiny on bond auctions in the months ahead.

Adding to the fiscal fireworks was the introduction of what is being dubbed the "Big Beautiful Bill"—a sweeping tax proposal that combines aggressive rate cuts with enhanced child tax credits and significant deregulation aimed at spurring economic growth.

Supporters argue the bill could ignite another leg of the post-COVID recovery. Critics, including members of the Republican Party, worry it could add over $5 trillion to the national debt over the next decade. The Committee for a Responsible Federal Budget labeled the proposal as "fiscally reckless," though markets responded positively to the growth implications.

House Republicans however, did advance the One Big Beautiful Bill out of committee.

Meanwhile, the 90-day tariff pause between the U.S. and China provided a major tailwind for risk assets. Both sides agreed to reduce duties to 10% from elevated levels, reversing years of tit-for-tat escalation. Notably, tariffs on fentanyl-related materials remain at 30%, likely more symbolic than impactful. The market’s enthusiastic reaction was driven less by the terms themselves and more by the symbolic de-escalation and potential for broader trade cooperation.

This "pause" buys time—but not necessarily clarity. The structural divides between the U.S. and China remain wide. For now, it acts as a short-term volatility suppressant, giving hedge funds an excuse to cover shorts and institutional allocators a reason to leg back into equity risk.

Perhaps most intriguing is the behavioral aspect of this rally: cash levels remain high, sentiment indicators are still cautious, and investors appear under-positioned. In other words, this is a "pain trade" higher. Breadth has improved, but participation remains uneven. Credit remains calm, but the cracks are forming. There’s no doubt this week was a win for bulls, but the foundations feel shakier than price alone might suggest.

Index and Sector movements

SPX makes a decisive move up on the monthly chart, and the secular uptrend is still intact.

The same goes for the Naz composite and the buy signal is almost there with the MACD about to cross on monthly.

This is all good news for secular bulls - looks like Trump tested the limit of what world leaders and the markets could handle. My hope is these trade wars settle without incident and have Trump focus on new issues (taxes, new business, securing the border, health, energy independance etc.) We will need to keep an eye on the China situation and any supply chain reverberations in the coming months.

On the Daily chart - both SPY and QQQ are well over their 200DMA, and good things happen once we cross this level.

Our SMA AI analysis also paints a bullish picture

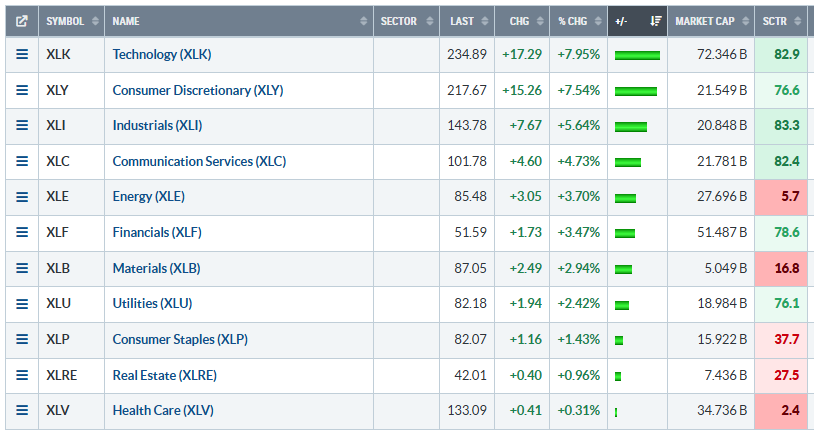

As expected, the bullish sectors continued to shine this week (XLK, XLY, XLI)

🛠 Technology (XLK): Led the rally, up nearly 8% on the week. Semiconductors (XSD +11.8%) and software names surged. Nvidia and Arista remained the top momentum leaders. Short-term outlook remains strong, but inflows are softening—watch for consolidation.

🏫 Consumer Discretionary (XLY): Gained +7.5% this week. Retail (XRT +8.6%) and housing-related names outperformed on the tariff relief and resilient demand. Sentiment here is flipping bullish, though Walmart's warning about inflation and tariffs tempers the enthusiasm.

⚖️ Industrials (XLI): Up +5.6% on the week, with strong participation in transportation and machinery stocks. Risk remains if trade rhetoric worsens, but supply chain recovery is driving optimism.

🚧 Energy (XLE): Rebounded +3.7% after a weak prior stretch. The setup is tactical; longer-term flows remain negative. Crude's rebound and hopes for China demand helped, but watch out for macro headlines.

🌎 Communication Services (XLC): Gained +4.7%, helped by ad-driven names. Despite the move, sentiment is neutral, and long-term flows are weakening.

🏡 Real Estate (XLRE): Lagged at +0.9%. Rates stayed range-bound, but the sector is weighed down by risk-off rotation.

⚕️ Healthcare (XLV): Barely moved (+0.3%), and continues to lag as UnitedHealth headlines linger. Relative strength remains weak.Sector Ceheck

The Relative Rotation Graph (RRG) reveals a clear leadership rotation favoring growth sectors. Technology (XLK) and Industrials (XLI) are firmly in the Leading quadrant with strong relative strength and momentum, confirming their outperformance this past week. Consumer Discretionary (XLY) is also in the Leading quadrant but closer to the boundary, signaling it could soon rotate toward Weakening unless momentum is sustained.

Energy (XLE) stands out in the Improving quadrant, showing a sharp upward move—suggesting potential early-stage leadership (keep this on watch).

In contrast, Healthcare (XLV) and Consumer Staples (XLP) remain in the Lagging quadrant, with weak momentum and deteriorating relative strength. Financials (XLF) and Real Estate (XLRE) are still under pressure and haven't begun their rotation back toward strength.

Market Internals

Internals still looking positive here, with cumulative Advance / Declines making new highs…this is bullish behavior.

Seasonality

Seasonality data shows strong historical performance for both SPY and QQQ between May and July, with SPY posting gains in 90–100% of Junes and Julys since 2016, and QQQ similarly strong in July and August. This aligns with the current momentum in equities following the U.S.–China tariff truce and a strong tech-led rally.

For now, seasonality favors the bulls, but we will will likely be lightening up on positions as we get closer to Aug-Sep timeframe, as policy and credit risks build.

Names on watch

We will keep these names on watch to add - will discuss more on chat during the week as we watch the market.

We will also keep an eye on balanced portfolio, which crushed it this week.

Last - we will be releasing our SMA AI Insights platform in the coming weeks - and I’ve included a preview of some of the picks from the AI insights platform

Keep reading with a 7-day free trial

Subscribe to Trading Thoughts with LCC007 to keep reading this post and get 7 days of free access to the full post archives.